7 SaaS Survey Questions Examples to Get Better Feedback

Looking for high-impact survey questions examples? See our top 7 types for SaaS to gather actionable feedback on onboarding, churn, NPS, and more.

Are you trying to figure out what your SaaS users really think? Getting good feedback comes down to the questions you ask. Knowing which type of question to use and when can be the difference between vague answers and clear, actionable insights. A well-designed survey helps you learn why users sign up, what makes them stay, and what might cause them to leave. These same principles for collecting high-quality data apply across different feedback scenarios, from user surveys to mastering your event feedback form.

This guide breaks down 7 key types of survey questions. We will provide specific survey questions examples for each category, focusing on what works best for SaaS companies. You'll see how to structure questions for onboarding, feature requests, churn analysis, and customer satisfaction. The goal is simple: to help you start collecting feedback that actually helps you grow your business. We will look at multiple-choice, Likert scale, Net Promoter Score (NPS), and open-ended questions, among others. By the end, you will have a clear framework for building surveys that deliver valuable user intelligence.

1. Multiple Choice Questions for Clear, Quantifiable Data

Multiple choice questions present respondents with a predefined list of answers. This structured format is excellent for gathering quantitative data because it groups responses into specific categories, making analysis straightforward and scalable. For SaaS companies, they are perfect for quickly understanding user behavior, such as which features are most used or how customers discovered your product.

These questions simplify the user experience and produce clean, easily segmentable data. The closed-ended nature prevents ambiguous answers, giving you reliable metrics to guide your product and marketing decisions.

Example: Feature Prioritization

Here is a common multiple choice survey question example:

"Which of these new features would be most valuable to you? (Please select one)"

- A) Advanced reporting dashboard

- B) Integration with Salesforce

- C) AI-powered workflow automation

- D) Mobile application access

- E) Other (please specify)

Strategic Analysis & Takeaways

This question type is highly effective for roadmap planning. By forcing a single choice, you find out what users truly prioritize, avoiding a scenario where everything is marked as "important."

Strategic Insight: A single-select multiple choice question reveals top-priority needs. A multiple-select (checkbox) question, in contrast, shows a broader range of interest but can dilute the focus. Use single-select for critical decisions.

Here’s how to get the most value from this approach:

- Actionable Takeaway: Always include an "Other (please specify)" option. This qualitative escape hatch can uncover brilliant ideas or needs your team hadn't considered. It’s a simple way to mix quantitative clarity with qualitative discovery.

- Tactical Tip: Rotate the order of the answers (randomize them) for each respondent. This prevents "order bias," where users tend to pick the first or last options more frequently. Most modern survey tools offer this functionality.

By using these targeted survey questions examples, your team can move from guessing what users want to knowing what they need, all backed by clear, quantifiable data.

2. Likert Scale Questions for Measuring Attitudes and Perceptions

Likert scale questions measure attitudes, opinions, and perceptions using a symmetric scale, typically ranging from "strongly disagree" to "strongly agree." Named after psychologist Rensis Likert, these questions capture degrees of sentiment rather than simple yes/no responses, providing valuable insight into the intensity of respondent feelings. This nuance is perfect for understanding customer satisfaction or employee engagement on a deeper level.

This method provides richer, more textured data than a binary choice. For SaaS companies, it’s a powerful tool to gauge how users feel about a new feature, the quality of customer support, or their overall satisfaction with the product. The scaled responses allow you to calculate an average score, giving you a benchmark to track over time.

Example: Customer Satisfaction

Here is a classic Likert scale survey question example:

"The onboarding process was easy to understand."

- 1 - Strongly Disagree

- 2 - Disagree

- 3 - Neither Agree nor Disagree

- 4 - Agree

- 5 - Strongly Agree

Strategic Analysis & Takeaways

This question format excels at turning subjective feelings into quantifiable data. It moves beyond "did they complete onboarding?" to "how did they feel about the onboarding experience?" which is a far more useful metric for product improvement.

Strategic Insight: Use an odd-numbered scale (like 1-5 or 1-7) to offer a true neutral midpoint. This prevents forcing respondents who are genuinely indifferent into a positive or negative camp, which keeps your data clean. For a deeper look at this, explore these additional Likert scale examples for surveys.

Here’s how to get the most value from this approach:

- Actionable Takeaway: Keep your scale direction consistent throughout the survey. If "1" means negative and "5" means positive for one question, maintain that pattern for all others. Inconsistency confuses respondents and corrupts your data.

- Tactical Tip: Clearly label the anchor points of your scale (e.g., 1 = Strongly Disagree, 5 = Strongly Agree). While labeling every single number can be overkill, defining the extremes is a necessity for clarity and reliable results.

By applying these specific survey questions examples, you can accurately measure user sentiment, track changes over time, and pinpoint exact areas of friction or delight within your customer journey.

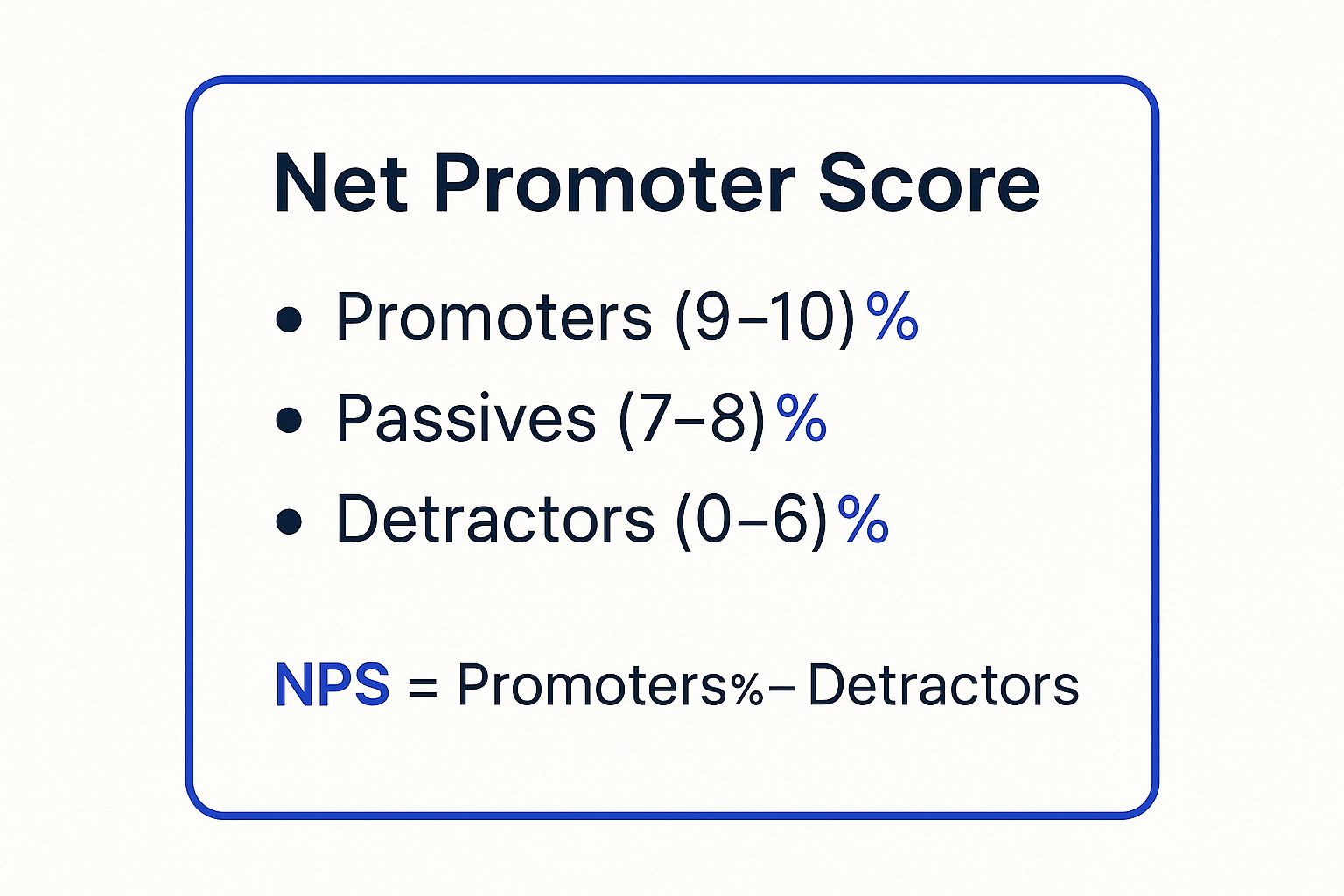

3. Net Promoter Score (NPS) Questions

Net Promoter Score (NPS) questions measure customer loyalty with a single, powerful query: how likely they are to recommend your product or service. This metric, pioneered by Fred Reichheld of Bain & Company, asks customers to rate their likelihood on a 0-10 scale. This simple score is a powerful indicator of overall customer satisfaction and a strong predictor of future growth.

Respondents are categorized based on their score: Promoters (9-10) are your loyal advocates, Passives (7-8) are satisfied but not enthusiastic, and Detractors (0-6) are unhappy customers. The final NPS is calculated by subtracting the percentage of Detractors from the percentage of Promoters, providing a clear benchmark for your company’s customer loyalty.

Example: SaaS Loyalty Benchmark

Here is one of the most common survey questions examples for a SaaS business:

"On a scale of 0 to 10, how likely are you to recommend our software to a friend or colleague?"

(Followed by an open-ended question)

"What is the primary reason for your score?"

Strategic Analysis & Takeaways

The real power of NPS is not the score itself, but the "why" behind it. The open-ended follow-up question provides the qualitative context needed to learn what drives loyalty or creates friction for your users.

Strategic Insight: Your NPS is a health metric, not just a number. It provides a constant pulse on customer sentiment. Tracking it over time is more valuable than focusing on a single, absolute score.

The following infographic breaks down how respondents are segmented to calculate your score.

This visualization shows how the simple 0-10 scale is translated into three distinct customer groups, which directly informs your customer success and product strategies.

Here’s how to get the most value from this approach:

- Actionable Takeaway: Always "close the loop" on feedback. Personally reach out to Detractors to solve their issues and engage with Promoters to learn what you’re doing right. This simple act can turn unhappy customers into loyal fans.

- Tactical Tip: Segment your NPS results. Analyze scores based on user personas, pricing tiers, or product usage levels. This will help you identify which customer segments are most at risk or which ones offer the greatest opportunity for advocacy.

4. Open-Ended Questions for Deep Qualitative Insights

Open-ended questions invite respondents to provide detailed, unrestricted answers in their own words. This qualitative format is vital for learning the "why" behind user actions and uncovering unexpected pain points or brilliant ideas that structured questions might miss. For SaaS companies, they are invaluable for capturing the authentic voice of the customer.

While the data requires more effort to analyze than quantitative responses, the depth of insight gained is often worth the investment. These questions add rich context to your numerical data, helping you learn user sentiment, motivations, and specific frustrations in a way multiple-choice answers cannot.

Example: Post-Churn Feedback

Here is one of the most powerful survey questions examples for a SaaS business:

"What is the primary reason you decided to cancel your subscription?"

Strategic Analysis & Takeaways

This question moves beyond generic reasons like "too expensive" or "missing features" by asking for the primary reason. It forces the respondent to reflect on the single biggest factor that led to their decision, providing your team with highly focused, actionable feedback to address churn.

Strategic Insight: Place your most critical open-ended question immediately after the action it relates to. Asking for churn reasons right after cancellation, or for onboarding feedback right after setup, captures the most accurate and immediate thoughts.

Here’s how to get the most value from this approach:

- Actionable Takeaway: Use text analysis tools or create a simple coding system to categorize responses. Group answers into themes like "Pricing," "Usability," "Specific Bug," or "Competitor Feature." This turns unstructured text into quantifiable data you can track over time.

- Tactical Tip: Ask specific, targeted open-ended questions instead of broad ones. "What could we do to improve your experience with our reporting feature?" will yield more useful feedback than a vague question like "How can we improve?"

By integrating open-ended survey questions examples into your feedback loops, your product and customer success teams can gather the rich, contextual stories needed to solve core problems and build a more user-centric product.

5. Rating Scale Questions for Granular Feedback

Rating scale questions ask respondents to evaluate a specific item along a numerical or descriptive continuum. This format is ideal for measuring subjective qualities like satisfaction, importance, or ease of use. For SaaS companies, they provide granular feedback on everything from the quality of customer support to the perceived value of individual features.

These questions offer more nuance than a simple yes/no answer but remain easy for respondents to complete quickly. The resulting data is quantitative and perfect for tracking performance, identifying areas for improvement, and establishing benchmarks over time.

Example: Post-Onboarding Experience

Here is a common rating scale survey question example:

"How would you rate the quality of your onboarding experience? (1 = Very Poor, 5 = Excellent)"

- 1 - Very Poor

- 2 - Poor

- 3 - Average

- 4 - Good

- 5 - Excellent

Strategic Analysis & Takeaways

This question type precisely measures user sentiment on a specific touchpoint. A 5-point scale gives you enough detail to spot trends without overwhelming the user with too many options, making it a reliable tool for gauging initial impressions.

Strategic Insight: The key to a great rating scale is its anchors. Vague labels like "Bad" and "Good" are less useful than specific, descriptive anchors like "Very Difficult" and "Very Easy." Clear labels help every respondent interpret the scale the same way.

Here’s how to get the most value from this approach:

- Actionable Takeaway: Use the data to create internal benchmarks. If your average onboarding score dips below a 4.2, it could trigger an automated review of your process or a follow-up survey to dig deeper. This turns passive feedback into an active monitoring system.

- Tactical Tip: Maintain consistency with your scales. If you use a 1-5 scale to measure satisfaction in one part of your survey, avoid switching to a 1-10 scale in another. A consistent approach makes the data easier to analyze and compare across different survey sections.

By incorporating these types of survey questions examples, you can systematically track and improve key aspects of the customer journey, from first contact to feature adoption, all with clear and comparable data.

6. Demographic Questions for Richer Segmentation

Demographic questions gather statistical data on respondent characteristics like age, role, location, and company size. This information provides important context, allowing you to segment responses and see how different user groups experience your product. For SaaS companies, this is the key to personalizing marketing, adjusting onboarding, and identifying ideal customer profiles.

By learning the "who" behind the "what," you can move from broad assumptions to data-driven personas. These questions transform raw feedback into nuanced insights, helping you see if, for example, users in a specific industry are struggling with a feature that users in another industry love.

Example: User Base Segmentation

Here are some common demographic survey questions examples:

"Which of the following best describes your role?"

- A) C-Level Executive (CEO, CTO, CFO)

- B) VP / Director

- C) Manager

- D) Individual Contributor

- E) Other (please specify)

"What is your company's approximate annual revenue?"

- A) Under $1 million

- B) $1 million to $10 million

- C) $10 million to $50 million

- D) Over $50 million

- E) Prefer not to answer

Strategic Analysis & Takeaways

Demographic data is your foundation for building accurate and useful user personas. Combining it with behavioral or attitudinal data reveals powerful correlations, such as which user roles are most likely to churn or which company sizes get the most value from your premium plan.

Strategic Insight: Always explain why you are asking for demographic information. A simple note like, "This information helps us better serve our users and improve our product for you," can significantly increase response rates and build trust.

Here’s how to get the most value from this approach:

- Actionable Takeaway: Place demographic questions at the end of your survey. Respondents are more likely to answer sensitive questions after they have already invested time in completing the rest of the survey. Leading with them can cause people to drop off early.

- Tactical Tip: Always include a "Prefer not to answer" or similar opt-out choice for every demographic question. This respects user privacy and prevents them from abandoning the survey entirely or providing false data just to proceed.

7. Matrix/Grid Questions for Efficient, Comparative Feedback

Matrix or grid questions group multiple related items into a table format, allowing respondents to evaluate them using the same set of response options. This structure is highly efficient for gathering comparative data, as it combines several questions into a single, compact grid. For SaaS companies, it is perfect for evaluating a set of product features, customer support interactions, or competitor attributes against a uniform scale.

This format streamlines the survey experience by reducing repetitive questions, which can lower survey fatigue and abandonment rates. The resulting data is neatly organized and ideal for comparing different items side-by-side, revealing relative strengths and weaknesses at a glance.

Example: Customer Support Evaluation

Here is a classic matrix/grid survey question example:

"Please rate your satisfaction with the following aspects of our customer support:"

Strategic Analysis & Takeaways

This question type excels at capturing detailed feedback on a single topic without overwhelming the user. It quickly highlights which specific components of a service or product are performing well and which need immediate attention.

Strategic Insight: The power of a matrix question lies in its comparative nature. You are not just measuring satisfaction with "support"; you are pinpointing that while your agents are friendly, the actual issue resolution is lagging.

Here’s how to get the most value from this approach:

- Actionable Takeaway: Keep the matrix focused and concise. Limit the number of rows to between 5 and 7 to prevent respondent fatigue and maintain data quality. If you have more items to rate, consider splitting them into multiple, smaller matrix questions. For more detailed guidance, see our post on mastering matrix questions in surveys.

- Tactical Tip: Make sure the rating scale (columns) is universally applicable to every item (rows). A mismatched scale can confuse respondents and produce invalid data. For example, do not mix items requiring a "satisfaction" scale with items requiring an "importance" scale in the same grid.

By using these targeted survey questions examples, your team can efficiently gather detailed, comparative data to make more precise operational improvements.

Survey Question Types Comparison

Turning Feedback into Growth with the Right Questions

The detailed survey questions examples we've explored are more than just templates; they are strategic tools for learning about your customers on a deeper level. From the structured clarity of multiple choice questions to the rich, qualitative detail of open-ended responses, each format serves a unique purpose. The true power emerges when you stop thinking about them as isolated queries and start seeing them as components of a complete feedback strategy.

A well-designed survey is a conversation. A Likert scale question can measure sentiment, while a follow-up open-ended question can uncover the why behind that feeling. A Net Promoter Score gives you a benchmark, but the subsequent questions about the rating are what provide the actionable roadmap for improvement. The goal is to move beyond simple data collection and into insight generation.

From Data Points to Actionable Insights

The difference between a good survey and a great one lies in its ability to drive action. Every question you ask should have a purpose tied to a potential business outcome.

- For Onboarding: Are you trying to identify points of friction? Use rating scales on specific setup steps.

- For Churn Deflection: Do you need to know why users leave? Deploy open-ended questions in your exit survey.

- For Feature Prioritization: Are you building your roadmap? Use matrix questions to gauge the importance and satisfaction of existing features.

By combining these different question types, you create a comprehensive view of the user experience. You can pinpoint what your most loyal customers love and identify the exact issues that push others away. This is the foundation for making informed product decisions, improving customer success processes, and ultimately, building a more user-centric SaaS business.

Activating Your Feedback Loop

Gathering this information is only the first step. The real challenge, and the greatest opportunity, is in systematically processing and acting on the feedback you receive. To fully harness the insights from your surveys and drive growth, consider exploring methods for improving customer feedback integration with AI. This approach can help automate the analysis of thousands of responses, identify emerging trends, and route important feedback to the right teams instantly.

Mastering the art of asking the right questions transforms feedback from a reactive support function into a proactive growth engine. You stop guessing what users want and start building a product based on direct, structured evidence. This shift is what separates fast-growing SaaS companies from the rest.

Ready to turn these survey questions examples into automated, actionable insights? Surva.ai is designed for SaaS teams to deploy intelligent surveys at the perfect moment in the user journey and analyze the results automatically. Start building a feedback engine that drives growth by visiting Surva.ai today.